What Are Sundry Expenses? Definition Which Means Instance

Sundry earnings is income earned from actions outside the company’s normal business operations. Not Like revenue from main actions such as product gross sales or service delivery, sundry income arises from incidental or one-off sources. It could come from a selection of sources corresponding to sundry meaning in accounting curiosity earnings, positive aspects from selling assets, or fees charged for late payments.

- The use and nature of sundry invoices range throughout industries depending on the kind and frequency of miscellaneous transactions.

- These small-value occasions present why a sundry account captures all monetary exercise with out overcomplicating the ledger.

- Managing sundry invoices, while useful for simplifying bookkeeping, additionally presents some unique challenges for businesses.

- Businesses should retain detailed documentation, corresponding to receipts, invoices, or bank statements, for all transactions, including those classified as sundry.

- By enhancing operational efficiency, companies can reduce the period of time and sources allotted to non-value-added actions.

What Are Sundries?

From workplace supplies to authorized fees, these expenses encompass a extensive selection of miscellaneous prices that are important for the day-to-day operations of an organization. A sundry expense in accounting refers to a miscellaneous expenditure that’s usually minor in worth and occurs occasionally. These prices do not fit into bigger, extra defined expense classes inside a business’s financial data, serving as an “other” or “miscellaneous” merchandise for difficult-to-classify particular person prices. For small, financially insignificant prices, it’s more sensible to group them than to create distinct accounts. The administrative burden of monitoring many separate accounts for small bills would outweigh the good factor about such detailed classification. By using a sundry class, companies maintain organized financial records which would possibly be straightforward to review, offering a clearer picture of great operational prices.

What Are The Frequent Errors In Recording Sundry Expenses?

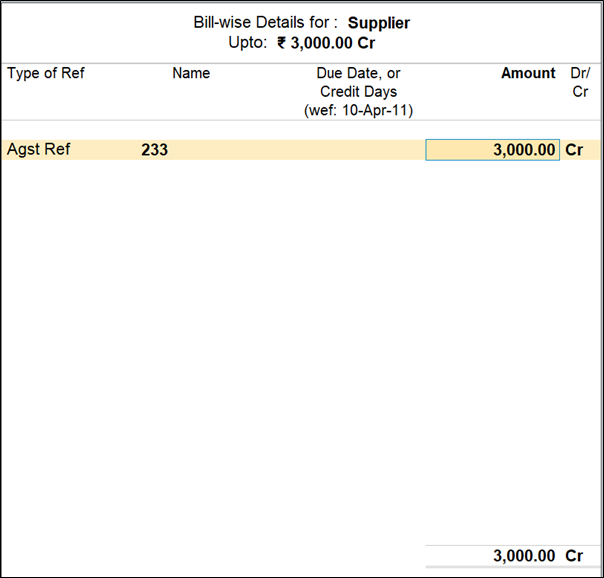

A sundry earnings entry includes a debit to a cash or checking account and a credit to the sundry income account. Conversely, a sundry expense entry entails a debit to the sundry expense account and a credit score to cash or accounts payable. These small-value occasions show why a sundry account captures all financial exercise without overcomplicating the ledger. Grouping minor transactions helps businesses preserve a clear overview of their monetary place. A sundry account features as a “catch-all” or “miscellaneous” account within a company’s general ledger. Its main role is to document transactions which are rare, small in value, or do not logically belong to some other current, extra particular account.

This type of bill is sent to the customer when the customer’s purchasing is unimportant. Ad-hoc expenses typically arise unexpectedly, such as last-minute purchases for workplace supplies or pressing repairs. These expenditures are not part of the regular budget and can be troublesome to anticipate. Sundry revenue also must be reported to the Internal Income Service (IRS) together with income generated from normal enterprise operations. Consulting legal consultants or compliance professionals helps be certain that sundry bill practices align with the relevant authorized framework, reducing the chance of penalties or litigation. The key difference between sundry collectors and common creditors lies within the frequency and size of the transactions.

Why Businesses Use Sundry Bills

By properly recording these expenditures, companies can provide a clear image of their monetary actions and ensure compliance with accounting standards. In small companies, sundry invoices help track miscellaneous gross sales or expenses that aren’t part of the core operations. For example, a small retail store would possibly sometimes https://www.kelleysbookkeeping.com/ sell objects on credit score to customers who do not frequently purchase on credit.

Sundry Invoices And Tax Implications

Sundry expenses are minor, rare, or miscellaneous costs that don’t match right into a business’s main expense categories. These expenditures are typically too small to warrant their very own devoted account within the company’s chart of accounts. In accounting, the time period “sundry” refers to small, irregular transactions that don’t quite match into any of the similar old categories, like workplace provides or employee salaries. It’s primarily a catch-all term for the miscellaneous objects in your financial records—those one-off bills or incomes that don’t happen often enough to have their own distinct class. If you’ve ever puzzled where to place that tiny expense for a quick coffee with a client or an odd fee for a one-time service, sundry transactions are doubtless your answer.

Sundry expenses embody a broad vary of minor costs that aren’t significant enough to have their ledger account. From stationery supplies to occasional miscellaneous expenses, sundry expenses are essential to the monetary landscape in both private and enterprise realms. The term “sundry” is derived from “sundry accounts,” referring to the numerous nature of these prices.

This is especially doubtless when a firm has numerous line objects on its revenue statement, and needs to condense the presentation. As you can see, none of these expenses could be predicted, nor can they be registered in the regular accounts. They also happen comparatively hardly ever, however they nonetheless have to be recorded – and the sundry account is the best place to take action.

In the money circulate statement, sundry revenue must be categorized correctly—often underneath “investing activities” or “financing actions,” relying on its supply. Accurate classification is critical for providing a comprehensive view of how these revenue streams affect liquidity and operational money move. Sundry expenses discuss with small, miscellaneous expenses that can not be categorized under a specific account. By enhancing operational effectivity, companies can scale back the amount of time and assets allotted to non-value-added activities. Automation benefits enable companies to streamline repetitive tasks, resulting in increased productiveness and cost financial savings.

Correct submitting of invoices, receipts, and correspondence supports audit readiness and tax compliance. Third, regularly review sundry accounts to establish uncommon patterns or discrepancies. Monitoring these accounts helps detect errors, fraud, or misclassification of transactions. One example is subscription fees for providers or products that are not part of the core enterprise offerings.